The forecast of finance for small business in 2024. Trends, tips, and ideas for business owners to prepare for the future ahead.

The forecast of finance for small business in 2024. Trends, tips, and ideas for business owners to prepare for the future ahead.

The FFCRA tax credit is available to self-employed business owners. Determine whether you are eligible to apply for the benefit and receive reimbursement for COVID related qualifying care.

Loan Mantra provides small business owners tips for their 2024 taxes.

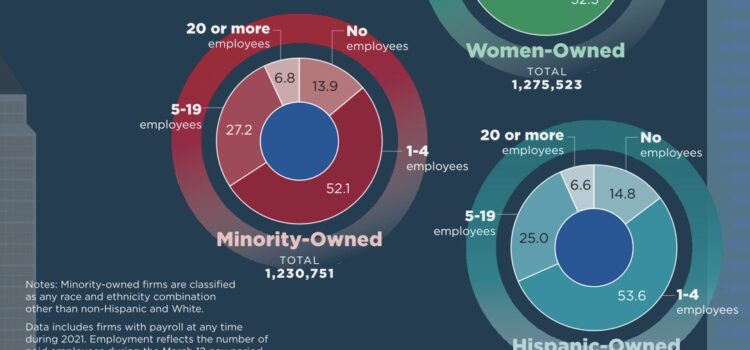

According to the latest U.S. Census figures, business owners that describe themselves as diverse, women and veteran owned account for 21 percent of small businesses. Not only is this an uptick in the statistic, a larger percentage than ever before, but the number of female-owned businesses is rapidly accelerating. The U.S. has 12.3 million women-owned […]

While Congress works to put a continuing resolution together to keep the U.S. government funded, a government shutdown has any number implications for small business owners. Starting October 1, 2023, major industries and the economy-at-large may be disrupted by a shutdown from Washington, with 91% of small business owners indicating a shutdown would significantly impact […]

The impact of a government shutdown on small business is a matter of significant concern, as revealed in a recent survey conducted by Goldman Sachs. Here are some key takeaways from the survey and why it matters: Government Shutdown: Negative Impact on Small Businesses: According to the survey, 91% of small business owners strongly favor […]

The experts at Loan Mantra share ten reasons why small business owners should adopt AI to grow their business.

How can your small business achieve financial freedom? Most business owners find that their personal financial success is tied to their business. Loan Mantra provides tips for ongoing financial success in your business and at home.

Are women-owned business owners still paying too much to play? Three tips for female entrepreneurs and business owners who suffer from historical gender bias when they seek start-up capital or additional forms of funding.

With the collapse of Silicon Valley Bank and Signature Bank, a global pandemic, and rising inflation, economic uncertainty looms ahead for the U.S. and global markets. Loan Mantra provides tips to recession-proof your small and medium-sized businesses to foster economic resiliency and survive the challenges ahead.