According to the latest U.S. Census figures, business owners that describe themselves as diverse, women and veteran owned account for 21 percent of small businesses. Not only is this an uptick in the statistic, a larger percentage than ever before, but the number of female-owned businesses is rapidly accelerating. The U.S. has 12.3 million women-owned businesses, which generates $1.8 trillion in revenue per year. The country also leads the way in growth for female businesses globally!

Despite these accomplishments, there are still forms of inequity when it comes to financing minority-owned businesses. Last year the National Community Reinvestment Coalition (NCRC) studied the changing small business lending landscape using New York as a baseline standard. They found that bank employees encouraged their white customers to apply for a small business loan more often than Black and Hispanic ones. Women-owned businesses also receive less capital from investors, business loans and grants. For instance, while venture capitalists invested $130 billion in U.S. startups in one recent year, only a tiny fraction of that – 2.2% – went to female business owners.

“Entrepreneurship is at an all-time high. Minority, women and veteran owned businesses are driving this growth. Financial institutions that don’t address the needs of the modern business owner will be left behind,” says Raj Tulshan, founder and partner at Loan Mantra, a company that democratizes the loan process by serving small business owners and financial institutions through one streamlined process.

So how do financial institutions reach and serve diverse business owners? Here are some ideas:

Provide Financial Information. Small business owners identify two obstacles to their success: Access to capital and financial education. As a financial institution, your goal is to provide straight-forward information to your clients in a way that is easily understood. Avoid using jargon and industry terms that may not be known by a general public.

Become an undercover boss. Randomly test your institution in stealth mode to gain insight into your client’s perspectives. What is the first thing you notice about your virtual or bricks-and-mortar outlets? Are your online, customer-facing systems easy to navigate? Or if a client physically walks into a branch of your bank, are they greeted and helped in a timely manner? Online statistics may help you understand how you stack up against your competitors.

Become a partner. Partner with minority-owned and operated businesses to reach new customers. As a minority-owned business, Loan Mantra understands the unique needs of segment communities, many which are underserved. Sixty percent of U.S. small business is minority, woman, or veteran owned. Forging financial partnerships with a diverse client base will enable you to access new communities and create more opportunities.

Reach out to the unbanked. According to the World Bank, close to one-third of adults – 1.7 billion individuals – remain unbanked with no access to a transaction account. This may occur for a few reasons. First, there are unbanked or underbanked populations who don’t have access to credit because their credit score is too low. But Millennials and Gen Z are looking to decentralized or financial technologies as a way to replace the traditional banking system. They haven’t bought houses or cars yet and are comfortable using online platforms to move cash around. Most often, these technologies are different than their parent’s financial systems. In other words, a pattern of a child banking at the same branch or credit union as their parents is dwindling. A savvy financial institution will be looking to technology, and to community-building, as a way of capturing younger markets.

Be open. Work with all clients, no matter how small the transaction. (Did you know that Loan Mantra started with one small, single account and has grown exponentially over the years?) Listen to the concerns of small business owners. We work with a variety of small businesses – and many first-generation businesses – and their feedback impacts our ecosystem.

Culture and growth. Inclusion starts with company culture, the ability to work well with different people, cultures and communities both inside and outside of the company. Leaders that have inclusive behavior become role models for associates. They make room for many points-of-view at the table. It’s wise to stay open to additional thought leadership.

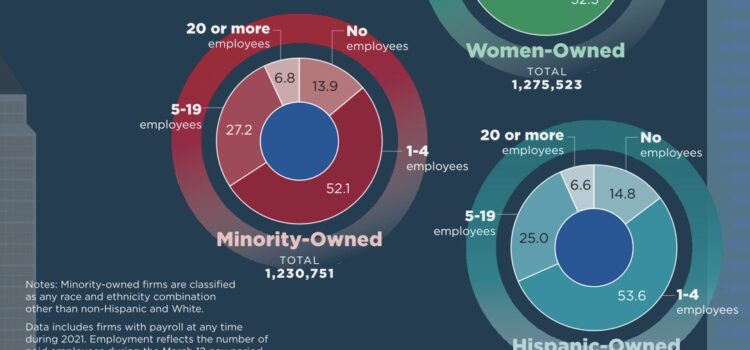

By the numbers:

The following is a round-up of the statistics from the most recent U.S. Census (2022).

- Veteran-owned businesses had an estimated $922.2 billion in receipts, 3.3 million employees, and $179.9 billion in annual payroll.

- Women-owned businesses had an estimated $2.1 trillion in receipts, 10.5 million employees, and $499.4 billion in annual payroll.

- There were an estimated 642,950 Asian-owned businesses in the United States in 2021, and an estimated 151,933 (24%) of them were in the Accommodation and Food Services sector. Asian-owned businesses had the largest estimated receipts ($1.0 trillion) among minority race groups.

- There were an estimated 161,031 Black or African American-owned businesses with $183.3 billion in annual receipts, 1.4 million employees, and about $53.6 billion in annual payroll. About 45,015 (28%) of these businesses were in the Health Care and Social Assistance sector.

- There were an estimated 48,582 American Indian and Alaska Native-owned businesses with $54.4 billion in receipts, 307,933 employees, and approximately $12.9 billion in annual payroll.

- There were an estimated 8,324 Native Hawaiian and Other Pacific Islander-owned businesses with approximately $10.5 billion in receipts, 53,277 employees, and $2.5 billion in annual payroll.

- The number of Hispanic-owned businesses grew about 8.2% from 375,256 in 2020 to 406,086 in 2021 and made up about 6.9% of all businesses with an estimated $572.9 billion in annual receipts, 3.0 million employees, and approximately $124.4 billion in annual payroll.